MAPping the Future

Column in THE INQUIRERSimplified Tax Regime for Micro and Small Enterprises

written by Mr. Raymond “Mon” A. Abrea - August 8, 2022Based on the March 2022 Labor Force Survey of the Philippine Statistics Authority (PSA), there are more than 17 million (M) informal sector workers, including tiangge (or flea market) and ambulant vendors, street vendors, and over 1.3M sari-sari stores which remain unregistered with the Bureau of Internal Revenue (BIR).

Generally, they fall under the category of micro enterprises. However, under Revenue Regulation 11-2000, self-employed individuals with annual gross sales or receipts not exceeding P100,000 are classified as marginal income earners. While they may also apply for BMBE (Barangay Micro Business Enterprises) certification to avail of income tax exemption, marginal income earners are exempted from tax compliance requirements, e.g.,

- P500 annual registration fee;

- maintaining books of accounts and submitting audited financial statements;

- issuing of official receipts or invoices;

- filing and paying 12% VAT or 3% percentage tax;

- filing and paying expanded withholding tax.

Should we increase the income threshold for marginal income earners to encourage the informal sector, including sari-sari stores, tiangge, ambulant and street vendors, to register with BIR? P100,000 annual gross sales or P8,333.33 monthly gross sales is even below the average daily sales of a sari-sari store.

Congress must revisit this and legislate a law redefining marginal income earners with a higher annual sales or revenue threshold from P100,000 to P1M and impose a fixed income tax of P1,000 payable after its first year of operation to encourage them to register with BIR, SSS, Pag-ibig, and Philhealth. In return, they get to file an income tax return which they can use to open bank accounts, apply for personal loans, and formalize their source of income.

Broadening the taxpayer base must not be confused or compromised with the goal of increasing tax collections. Digital transformation must aid and further simplify both registration and compliance with lower or flat tax to encourage more individual taxpayers to register, file and pay taxes.

Further, tax compliance must provide non-fiscal incentives, like access to credit or working capital for marginal income earners.

Under the BMBE Act of 2002, any individual or corporate taxpayer engaged in business, not a practice of a profession, may apply for BMBE certification provided their total assets do not exceed P3M. The law provides benefits as follows:

- Exemption from income tax;

- Exemption from the coverage of Minimum Wage Law;

- Access to financial assistance;

- Access to training and technology transfer.

Note, however, that the exemption is from income tax. Therefore, a BMBE certified enterprise is still required to file and pay business tax, either 3% percentage tax quarterly if the annual gross sales or receipts do not exceed P3M or 12% VAT monthly and quarterly if the annual gross sales or receipts exceed the P3M threshold.

While most of them remain in the informal sector, they continue to contribute in our economy through their accumulated spending or disbursements. More than collecting taxes from this sector, the government must provide financial assistance and training programs, and other services to help them grow and sustain their businesses.

So, how do we further simplify tax compliance for micro and small enterprises to formalize or register all them?

FIRST, we need to register all gainfully employed and self-employed individuals, including foreigners and corporations, to broaden the taxpayer base, regardless of whether they are exempted from paying income tax or not. The key is to have a comprehensive database based on the total population.

Maybe BIR can work with the National Economic and Development Authority (NEDA) and use the Philippine Identification System (PhilSys) to make sure that 100% of the total employed and self-employed individuals are registered with BIR, and are given a tax identification number (TIN).

Also, the BIR can secure databases from other government agencies to compare or update its taxpayer database, e.g.:

- Securities and Exchange Commission (SEC) for non-individual or corporate taxpayers – for profit or non-for-profit organizations;

- SSS, PAG-IBIG, Philhealth for individual taxpayers – employed and self-employed who registered under voluntary payment system;

- OWWA for overseas Filipino workers (OFWs);

- Department of Trade and Industry (DTI) for self-employed or sole proprietors;

- Department of Foreign Affairs (DFA) for foreigners or alien individuals who are gainfully employed or doing business in the Philippines;

- Professional Regulatory Commission (PRC) for licensed professionals, like doctors, accountants, engineers, etc.;

- Supreme Court and Integrated Bar of the Philippines (IBP) for lawyers;

- Google for content creators or influencers earning royalty through YouTube;

- Lazada, Shopee, FoodPanda, Grab, Angkas and other digital platforms or orchestrators, including online games and live-streaming apps for registered sellers, drivers or players generating income through their platforms or app.

SECOND, the government must provide fiscal and non-fiscal incentives to encourage them to register, e.g.:

- Tax holiday for the first two years or P1M income of startups. This can still be included in the proposed Internet Transaction Act;

- Generation of tax returns for informal sectors so they can use it to open a bank account or apply for personal/business loan, visa, etc.

- Offer an interest-free working capital or loan for micro enterprises payable in 2-3 years where they will be given a target profit or cash position to renew their loan or avail more incentives;

- Priority suppliers or contractors for government procurement or projects;

- Access to free training seminars, trade expos and inclusion in the database of registered MSMEs which will be preferred suppliers for both private and public procurements.

THIRD, allow an optional 10% flat tax in lieu of all taxes and remove non value-added and very costly compliance, including books of accounts. The requisite to avail the flat tax must be the use of electronic invoicing and online submission of profit and loss statements to monitor the sales and performance of the micro and small enterprises.

Once we have addressed the tax gap from unregistered taxpayers, we can focus now on the tax gap from undeclared income to broaden the tax base which is equally important in improving tax collections. The full implementation of the electronic invoicing system under the TRAIN Law will be helpful as it captures the actual sales of businesses. Effective January 2023, the use of eInvoicing will be mandatory for large taxpayers, eCommerce businesses and exporters.

Immediate priority is to revisit the qualification or threshold to be classified as large taxpayers owing to the fact that they contribute more than 60% of the total collections. If we can double the number of companies classified as large taxpayers, then BIR can clearly and easily focus on their compliance using data analytics and industry benchmarking to further increase the voluntary payments.

Finally, instead of auditing the same companies every year, the BIR must adopt a risk-based audit — that means only high-risk taxpayers must be audited. And the full force of the law must be enforced to tax evaders to serve as a deterrent, i.e., deport foreign or alien individuals who do not pay taxes, dismiss or permanently disqualify public officials and revoke the CPA license of accountants who will be involved in any tax evasion case as provided in Section 253 of the tax code.

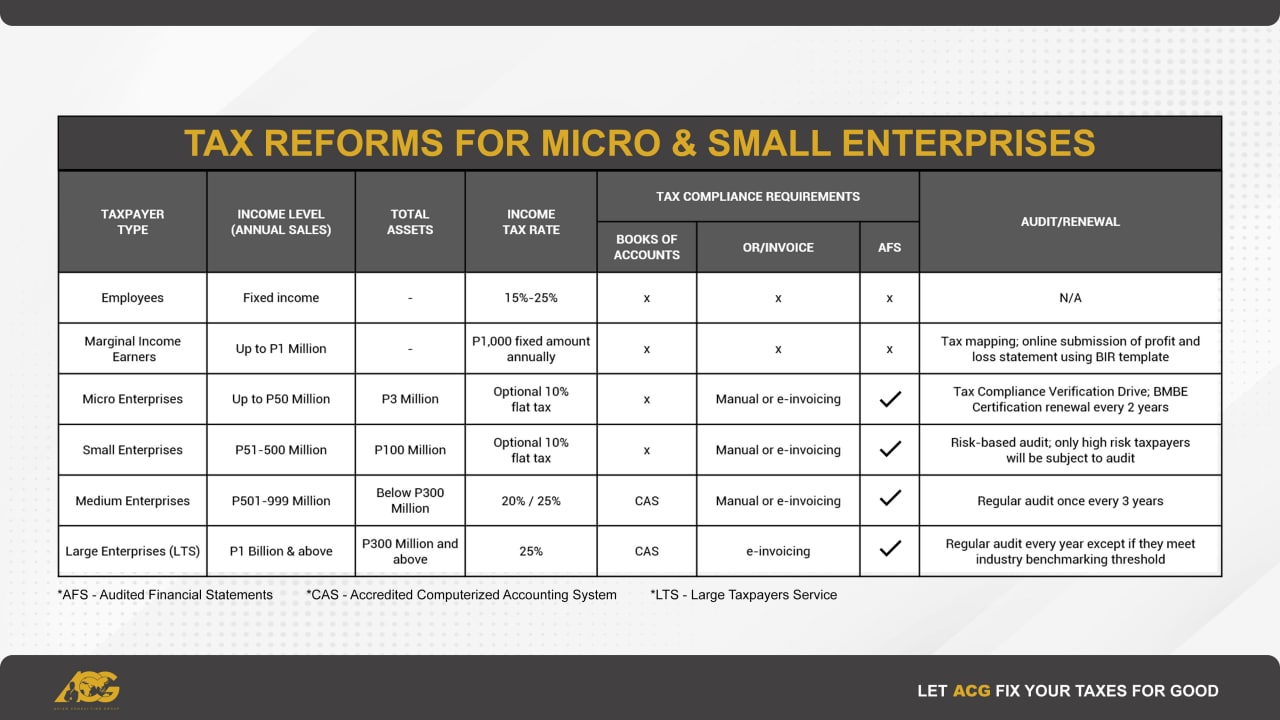

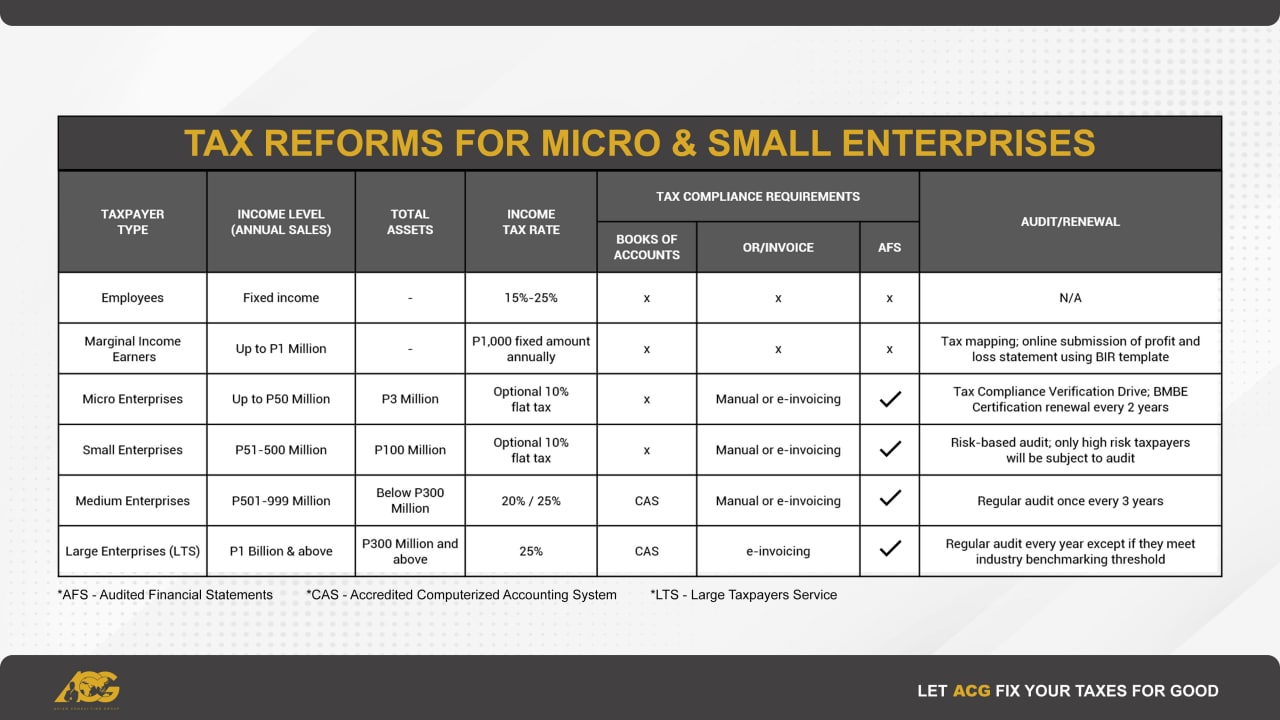

Here’s the summary of a simplified tax regime for micro and small enterprises:

The proposed simplified tax regime for micro and small enterprises will more likely increase registered individual taxpayers and voluntary compliance without imposing new taxes. While the BIR is completing its digital transformation, it must reallocate its resources and focus on narrowing the tax gap and broadening the taxpayer base to increase voluntary compliance without relying on random audit and investigation which result in compromises.

(This article reflects the personal opinion of the author and does not reflect the official stand of the Management Association of the Philippines or MAP. The author is Member of the MAP Ease of Doing Business Committee, Founding Chair and Senior Tax Advisor of Asian Consulting Group and Co-Chair of Paying Taxes – EODB Task Force. He is Trustee of CSR Philippines – the advocacy partner of the BIR, Department of Trade and Industry (DTI), and Anti-Red Tape Authority (ARTA) on ease of doing business and tax reform. Feedback via map@map.org.ph and mon@acg.ph).